What is Selective Licensing?

Selective Licensing allows a local authority to respond to local concerns such as poverty or immigration, by requiring different licences from landlords. The requirement for a license can also be isolated to small areas within an authorities’ jurisdiction and not act as a blanket rule.

When an authority designates an area for licensing, it applies to all privately rented homes in that area, unless a property falls under certain exceptions listed in the Selective Licensing of Houses (Specified Exemptions).

However, if a property is a House in Multiple Occupation and already requires a license under Part 2 of the Act, it doesn’t need another selective license.

As of April 1, 2015, if this scheme affects more than 20% of privately rented homes in the area under the jurisdiction of the local authority, the local authority must get approval from the Secretary of State for Levelling Up, Housing, and Communities. If the designation covers 20% or less of the area, it doesn’t need this extra approval. The authority must also follow certain legal requirements and consult with the public for at least 10 weeks before making these decisions.

If the local authority has multiple designations at the same time and each covers less than 20% of the area, then they are still required to submit all of the schemes to the Secretary of State for confirmation, if cumulatively they account for more than 20%.

Why might a local housing authority introduce a license?

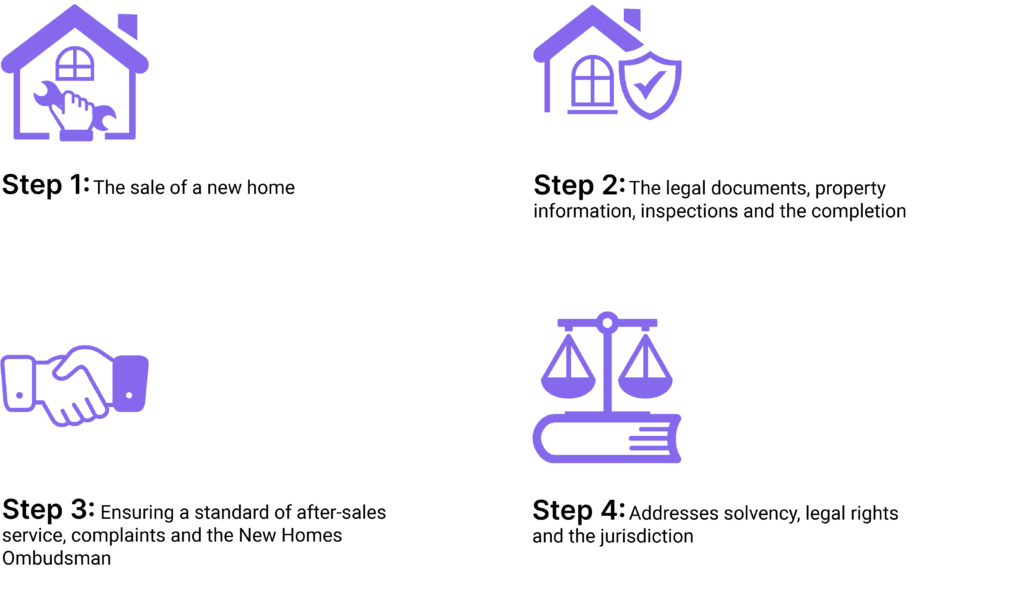

There are a few reasons a local authority might introduce a license, but the designation has to satisfy one or more of the following conditions:

- Low housing demand or that it’s likely to become low

- High level of deprivation

- Poor housing conditions

- Significant and persistent anti-social behaviour problems

- High levels of crime

- High levels of migration

There are then further restrictions to designating a Selective License. For the following conditions, a designation may only be made where there is a high proportion of homes in the private rented sector:

- Poor housing conditions and/or

- Migration

- Deprivation

- Crime

What's the penalty for not not having a selective license?

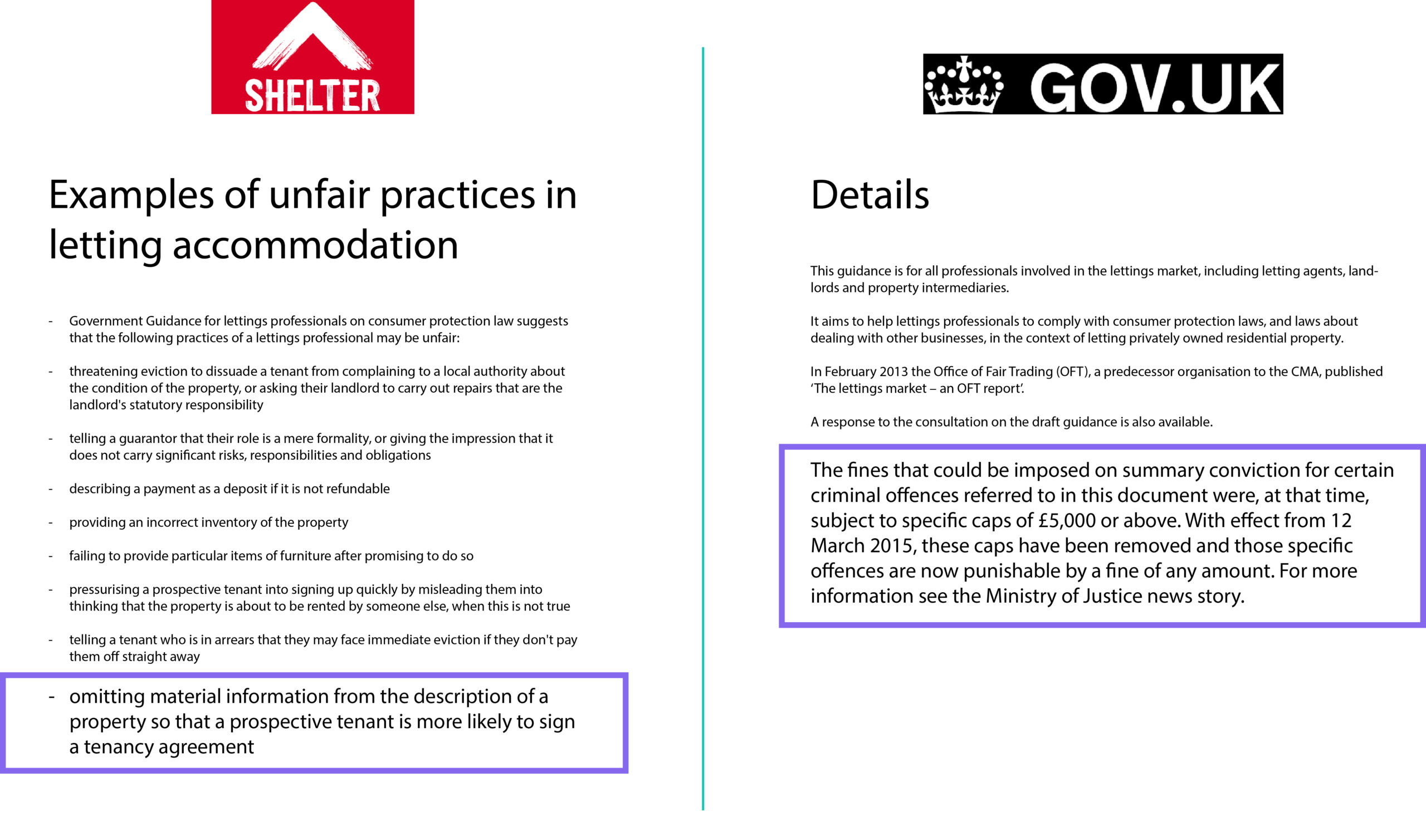

Shelter has provided an outline of potential penalties for not having a Selective License where required.

“Where a property should be but has not been licensed, or a license has been obtained but its conditions are breached, a range of sanctions may be available.

These are:

- Offences can be punished on conviction by a fine

A local authority can impose a civil penalty of up to £30,000 as an alternative to prosecution

A rent repayment order (RRO) can be obtained but only in respect of a period where a property has been let unlicensed when it should have been licensed

The landlord could be subject to a banning order

The landlord cannot serve a section 21 notice requiring possession of an assured shorthold tenancy during the unlicensed period”

London Property Licensing reports of one landlord in Brent being ordered to pay a £90,000 penalty.

“Applying to license the three private rented properties would have cost the landlord £1,620, as Brent Council charge a fixed application fee of £540 per property for up to five years.

However, on 28 January 2020, they were ordered by the court to pay a £25,000 fine for each of the unlicensed properties, £5,000 for failing to supply documents to the council when required to do so, and £10,763 in court costs to the council, totalling £90,863 including a victim surcharge.”

How can a landlord find out if they need a Selective License?

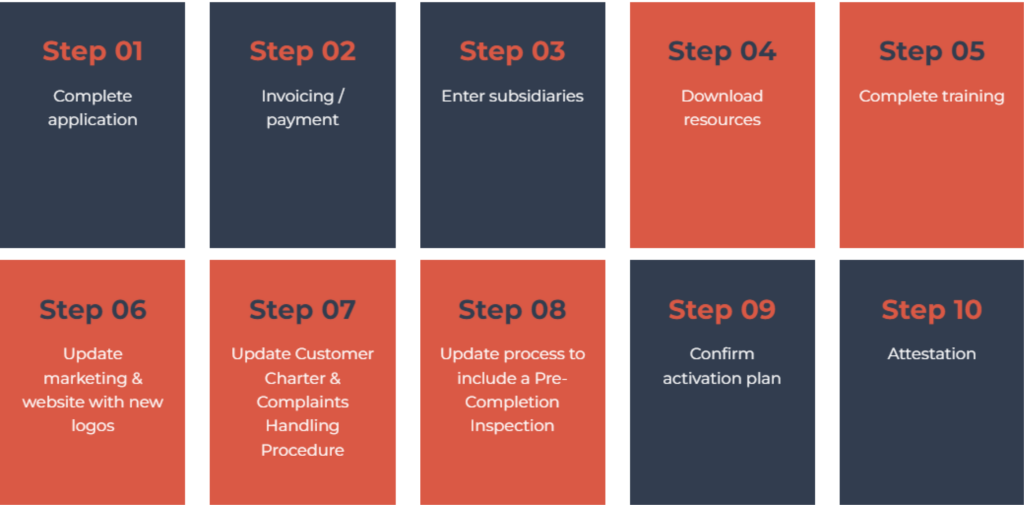

As the need for a Selective License, and the specific requirements for that license changes between local authorities and postcodes, the local authority for the property being rented should be consulted. Here are 4 steps to check and verify any Selective License requirements for a property:

Identify Your Location: Determine which local authority governs your property. You can find this information by searching online or contacting your local council.

Check the Local Rules: Visit the website of your local authority or contact them directly to find information about Selective Licensing schemes in your area. They will provide details about whether Selective Licensing is required, which types of properties it applies to, and any exemptions.

Review the Criteria: Typically, Selective Licensing is applied to certain geographical areas or specific types of properties where there are issues with housing conditions, anti-social behaviour, or other concerns. Your local authority will outline the criteria that trigger the need for a Selective License.

Check for Exemptions: Some properties may be exempt from Selective Licensing requirements. Common exemptions include properties already licensed as Houses in Multiple Occupation (HMOs) or those covered by other licensing schemes. Verify if your property falls under any exemptions outlined by your local authority.

Applying for a License:

If your property falls within the area covered by a Selective Licensing scheme, and it’s not exempt, you will need to apply for a license from your local authority. They will provide you with application forms and instructions on how to proceed.

Remember that failure to obtain the required Selective License when necessary can result in penalties and legal consequences, so it’s important to follow the regulations set by your local authority. If a landlord has multiple properties in their portfolio, it is very likely that each property will require different licenses. Therefore, a landlord should ensure each property is checked even if two properties are close to one another.

If this all seems like a bit of a mine-field with multiple properties requiring different licenses, we’ve seen that Yuno could be a particularly helpful tool. They provide a user with “alerts when your property(s) is affected by changes to local and national legislation, including Licensing and Article 4 Planning permission. Yuno will provide a clear process and solution to ensure you are compliant.”

In conclusion

Selective Licensing is a regulatory tool used by local authorities to address specific local concerns related to housing conditions and community well-being. These licensing requirements can be tailored to apply to particular areas within an authority’s jurisdiction, rather than being a one-size-fits-all rule.

Property owners should consult their local authority to determine whether they need a Selective License, as the criteria and exemptions can vary by location. Failing to obtain the necessary license can result in penalties, including fines and other legal consequences.

It’s essential for landlords and property owners to stay informed about the regulations in their area, follow the appropriate application process if required, and ensure compliance with the law to avoid potential financial and legal repercussions.