Do buyers understand the impact of a staged ending to the Help to Buy scheme?

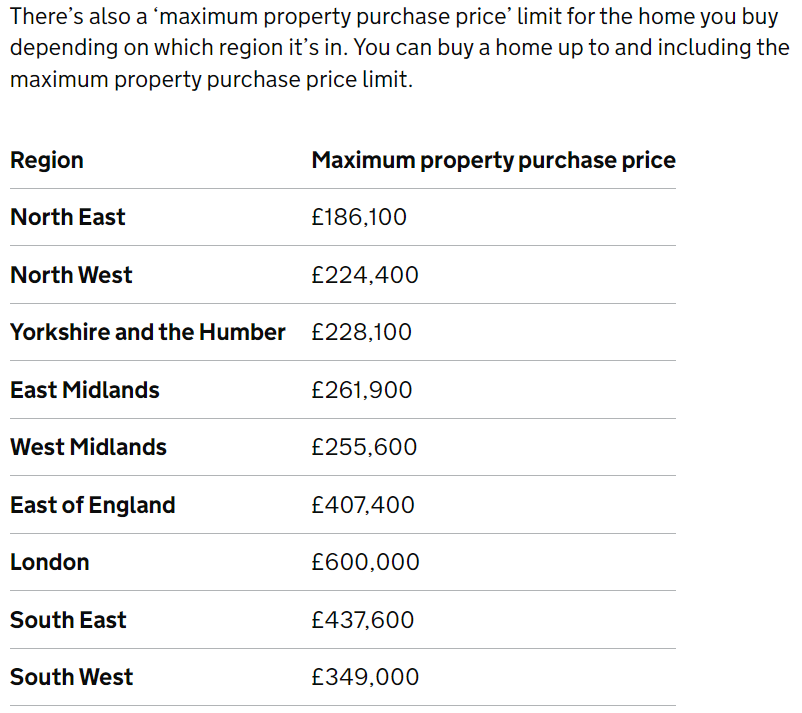

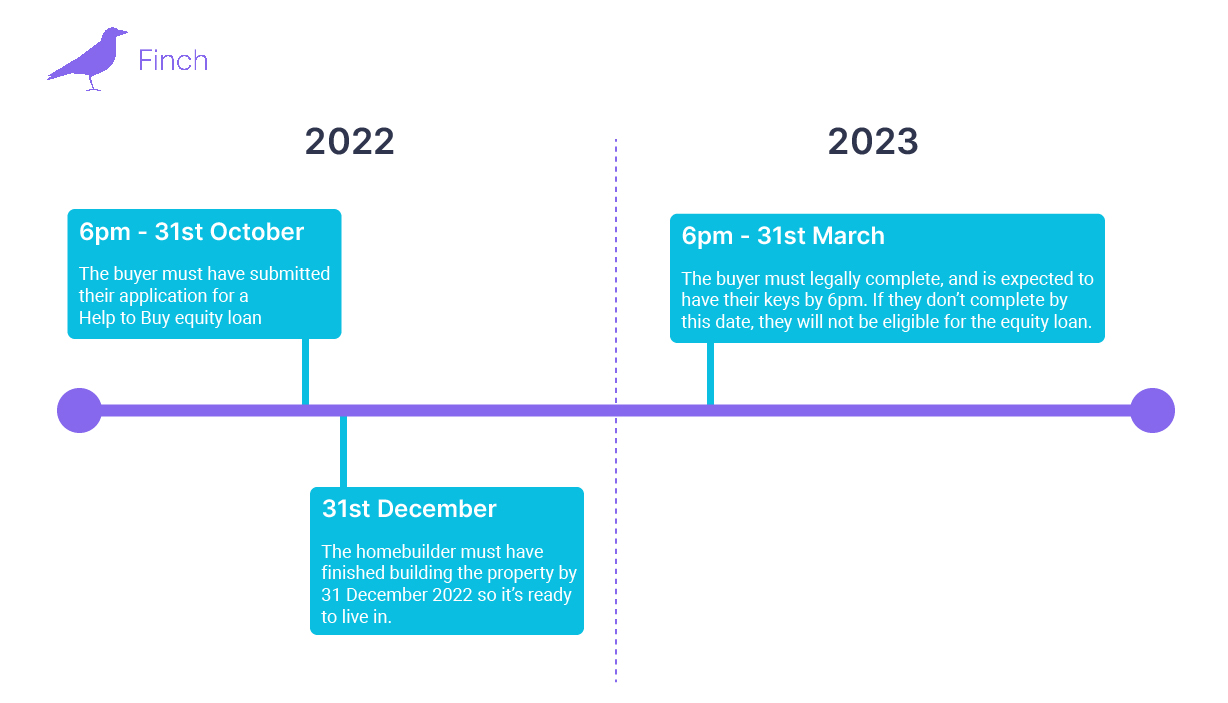

The full economic consequence of ending the Help to Buy scheme isn’t yet known. But whilst much speculation exists within the industry around the pros & cons, there is clarity for the final stages. The way the scheme will be brought to a close has been clearly defined, including definitions for the eligibility to submit applications, the specific geographical financial value bands for borrowing, and ultimately, the explicit steps which will be taken to close the scheme.

Help to Buy is a government scheme for first time buyers. It is a loan that a buyer puts towards the cost of a new build. For those who are eligible, they can borrow 20% of the property’s value, or up to 40% for those in London. Throughout the term of the loan, the buyer isn’t required to pay off the loan, but the interest on the amount borrowed. When the property is sold, all the equity loan must be repaid.

Why was the Help to Buy equity loan scheme created?

- Be 18 or over

- Be a first time buyer

- Be able to afford the fees and interest payments

The property being purchased must:

- Be a new build

- Be sold by a Help to Buy registered home builder

- Be the only home the buyer owns and lives in

If a person has owned a home or residential land in the UK or abroad, they are ineligible. They’re also ineligible if they’ve had sharia mortgage finance.

How will the scheme closure deadlines impact imminent and accepted applications?

A buyer must submit their application for an equity loan by 31st October. Homebuilders must have registered the property onto the scheme for this to be possible. The buyer must also have a PIF (Property Information Form) submitted to a Help to Buy agent, prior to the deadline. Anyone purchasing at this late stage must check (for their own peace of mind) with their homebuilder to ensure a qualifying property completion deadline will be met and that the home will be built before the new year. A new home warranty is also required by the final day of 2022.

What if a property isn’t ready in time?

- If a homebuilder is unable to complete by the deadline, the homebuilder must return the full reservation fee.

- If a buyer has exchanged, the homebuilder must release them from the contract unconditionally and return the deposit.

- Legal fees and financial advice costs, may still need to be paid.

“The First Longstop Date is 31 December 2022, and this is the practical completion deadline. Your homebuilder must have finished building your home so it’s ready to live in, and your home must have received a new-home warranty to be eligible for Help to Buy.”

“The Second Longstop Date is 31 March 2023, and this is the legal completion deadline. This is the last date you and your homebuilder can legally complete the purchase of your home“

Is there a replacement for the Help to Buy equity loan scheme?

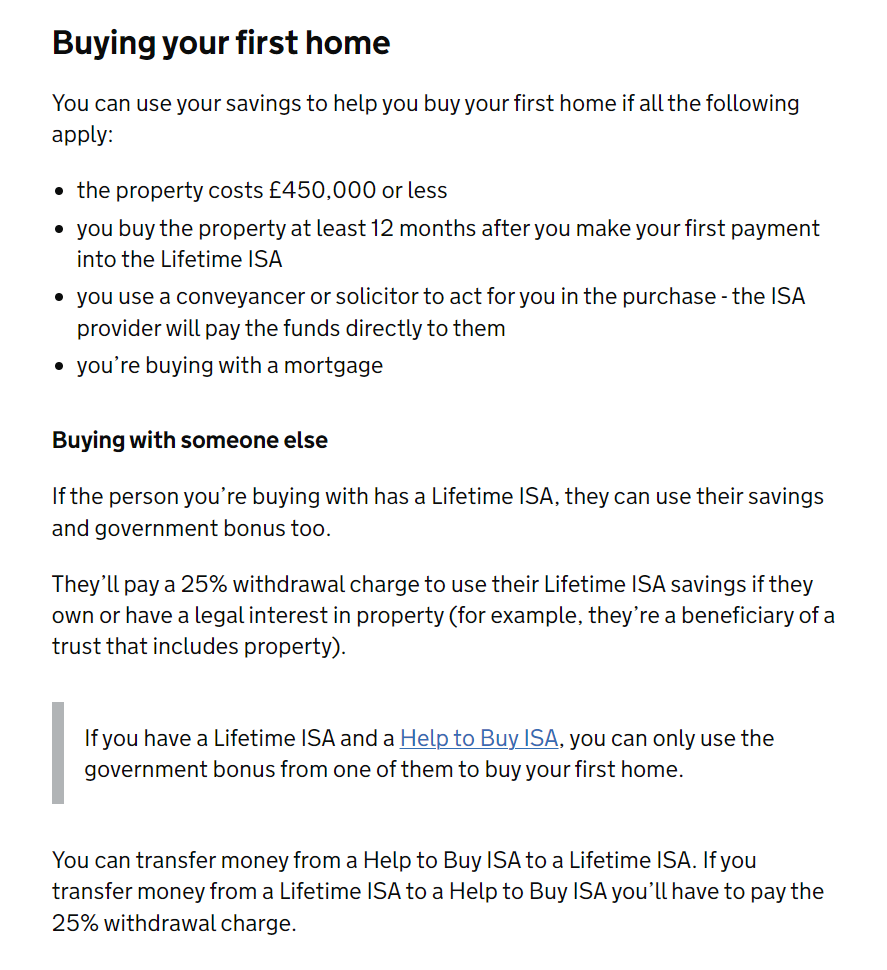

Are Lifetime ISA’s an alternative to Help to Buy ISA’s?

Lifetime Individual Savings Account’s aren’t a new scheme. The Lifetime ISA’s have been around from 2017 and were not created as a replacement for Help to Buy, but have been used in conjunction. A person can only use the government bonus from one of them for a property (even though they both offer 25%). Lifetime ISA’s also come with eligibility requirements. These include a person being 18 or over but under 40. There is a maximum value to save each year which is £4,000, until that person reaches the age of 50. The government pays out a bonus of 25% up to a maximum of £1000 per year (annual ISA limits also apply here).

“If you have a Lifetime ISA and a Help to Buy ISA, you can only use the government bonus from one of them to buy your first home.

You can transfer money from a Help to Buy ISA to a Lifetime ISA. If you transfer money from a Lifetime ISA to a Help to Buy ISA you’ll have to pay the 25% withdrawal charge.” – GOV.UK