Using innovative technologies to onboard British employees

According to law, all UK employers must complete right to work checks for new British employees. The right to work process includes collecting and verifying documentation for an employer to confirm that the job applicant is allowed to work for them. In fact, employers can face a civil penalty if they employ an illegal worker or have not carried out the correct right to work check.

Until now, interviews with potential candidates and right to work checks were required to happen face-to-face, again prescribed by the government. One of the main reasons for this was that both the identity of the applicant and the documents they provided needed to be verified in person.

During the restrictions put in place as a result of Covid-19, the government permitted virtual right to work checks, but this will be ending soon. The country will be reverting back to a face-to-face process, barring a few approved virtual right to work check vendors.

Using innovative technology, we have developed an app that we believe will streamline and improve the onboarding process for British employees.

The information-gathering needed for British recruitment

After a face-to-face interview and if the applicant is successful, a right to work check must take place. The successful candidate must send the employer documentation to prove their right to work. The applicant must then visit the employer’s office with original versions of all the documents previously provided, and the employer must then conduct laborious checks on each document.

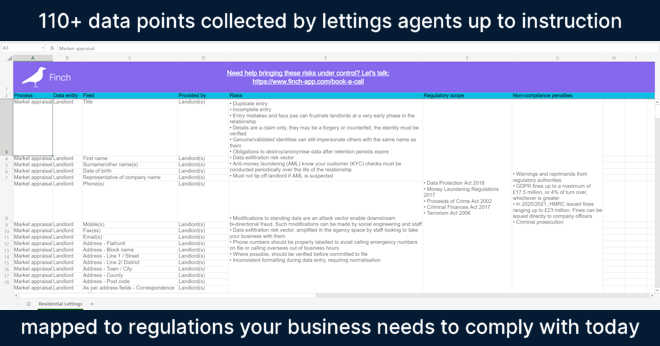

Employers are required to check the following during the right to work check, as per UK law:

- They must check that all the documents provided are genuine, original, unchanged, and belong to the applicant in a face-to-face meeting.

- They need to check that the dates on the applicant’s right to work in the UK have not expired.

- Employers must ensure photographs are the same across all documents.

- They need to check that the applicant has permission to do the type of work offered, including any limitations on the number of hours they can work.

- In the case where the applicant is a student, the employer must be provided with evidence of their study and vacation times.

- If the documents presented have different names on them, the employer must receive supporting documents showing why they’re different.

Perhaps the most frustrating part of the right to work process for both the employer and the new employee is that if any step in the process is missed or occurs incorrectly, the process has to start over from the beginning.

How Covid-19 changed the onboarding of British employees

When the Covid-19 pandemic hit the UK, harsh restrictions were put in place by the government, including total lockdowns. As restrictions eased and companies could function again, the government made provisions to allow the right to work checks to happen virtually.

From 30 March 2020, the government allowed employers to conduct interviews virtually via video call platforms like Zoom or Microsoft Teams. They were also permitted to conduct a provisional right to work check via video call, where the applicant was required to hold up their original documents to the camera for verification. It was also permitted that Identification Document Validation Technology (IDVT) could be used to carry out the checks.

However, employers must still conduct a face-to-face verification of the applicant’s documentation as soon as possible following the remote check. Following the end of temporary Covid-19 measures, a deadline will be enforced for right to work checks conducted provisionally to be completed either in person or using post-pandemic rules.

What changes post-pandemic?

When restrictions eased completely, and the UK economy settled into the new norm, the government released new guidance that, from 17 May 2021, virtual right to work checks were no longer allowed. They stated that the face-to-face process was to be restored.

However, after some consideration, the guidance has changed once more. Virtual right to work checks are still permitted until and including 30 September 2022. Thereafter, right to work checks must either happen in person or through government-approved technology vendors.

From 1 October 2022, employers can conduct right to work checks and onboard new employees remotely through complaint digital trust frameworks. For the first time ever, employers will be able to conduct the right to work check entirely remotely.

How a Right to Work app changes employee onboarding

We have developed an app that we believe is the perfect alternative to face-to-face and video call right to work checks. The face-to-face process is archaic and unnecessary, and holding up documents on a video call is a risky way to verify someone’s right to work information.

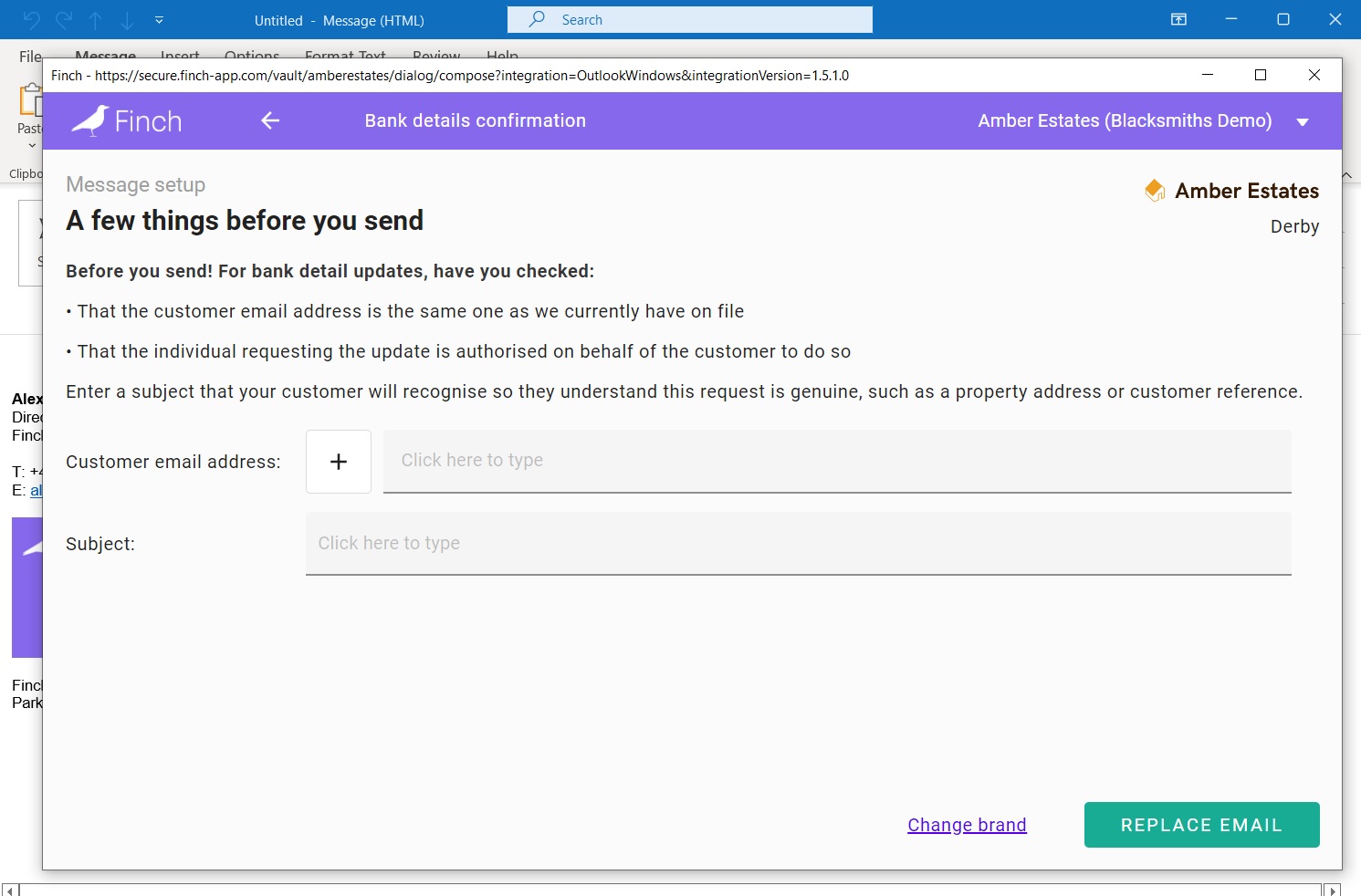

The Right to Work app is an innovative remedy as it allows for the entire right to work check process to happen virtually on one secure app. Right to Work is a fully digital, remote complaint solution that allows for the right to work check to happen virtually. It also ensures that every step of the right to work check is completed in full and accurately, preventing the employee and candidate from starting over again as mistakes won’t be made – this ultimately saves time and money.

Right to Work allows employers to provide successful applicants with their job offer, letter of employment, and contract – which they can sign electronically on the app. All records of the documents in the right to work check process are stored safely in our vault, which can be accessed by HR.

You’re also able to verify bank details for payroll, capture ID in a compliant way with the UK digital trust framework, and have all documents signed electronically.

!

!